Navigating the perfect storm: fuel risk, regulation & tariffs

By Kim Rosello and Duncan Ross, Paratus & Partners

In today’s shipping environment, managing fuel costs is no longer a matter of watching the indices and hoping for a favourable market. We’ve entered a new era – one where fuel price volatility is just a part of a much larger risk equation, shaped by shifting tariffs, evolving emissions regulation, AI-driven transformation, and global instability. This isn’t just a perfect storm; it’s a permanent seismic shift in how shipping must think about cost, compliance, and competitiveness.

At Paratus & Partners, we’ve seen this change first-hand. Working with operators, traders, and logistics professionals globally, it’s clear the smartest in the room are no longer asking, ‘What’s happening next?’ but rather, ‘How do we adapt better than the rest?’.

Tariffs and the impact on bunker exposure

Trade policy is back at the centre of global logistics, and this time, it’s bringing bunker risk along for the ride. Uncertainty looms on all sides over where tariffs (and retaliatory tariffs) will land in the future. This persistent unpredictability continues to cast a shadow over general trading patterns and causes knock-on effects for bunker prices at worldwide bunker hubs.

For many, this has meant longer voyage legs, shorter-term charters, and costlier repositioning, which all impact fuel consumption and planning. Fuel prices, especially in key supply hubs, are now reacting to shifting trade flows rather than purely demand-side fundamentals. In mid-2024, price spikes in Singapore and Fujairah reflected just how fast redirected trade can ripple into bunker markets.

What’s more, the uncertainty around tariff longevity adds strategic opacity. Will policies last through a political cycle? Will retaliatory measures be introduced? For ship operators, each twist potentially alters voyage economics—and increases fuel price exposure mid-fixture.

The lesson is simple: bunker strategy can no longer be a trailing consideration. It must sit alongside chartering, route planning, and customer engagement from the outset.

Emissions regulation: a moving target with financial implications

Environmental regulation is now a hard commercial factor. The EU Emissions Trading System (ETS), fully in effect since January 2024, requires vessels over 5,000 GT calling at EU ports to purchase emissions allowances for 40% of their reported CO₂ output – scaling to 100% by 2026. For a single Far East–Europe loop, this can add several hundred thousand dollars to voyage costs.

But, the EU ETS is just the beginning.

The International Maritime Organisation (IMO’s) revised 2023 Greenhouse Gas Emission strategy, and its pending carbon pricing mechanism due for vote in late 2025, could introduce a global fee system by 2027, with actual financial obligations kicking in by 2028.

Current draft proposals include a base fee of around $100 per tonne of CO₂, rising to $380 per tonne for vessels that exceed defined emissions thresholds. While the details are far from finalised, the message is clear: a price on carbon at the international level is coming.

Importantly, all of this remains subject to negotiation. Fee structures, benchmarks, and compliance mechanisms are yet to be set in stone. This regulatory ambiguity makes planning difficult – and exposes operators to the risk of being caught flat-footed.

And with many retrofitting or alternative-fuel solutions still prohibitively expensive for midsize players, operators are left with a stark reality: emissions costs must be priced into operations now or absorbed later at potentially punitive levels.

AI and automation: untangling the complexity

Amid the growing complexity, artificial intelligence is rapidly emerging as a powerful tool in the modern operator’s arsenal. AI-driven platforms are now being deployed to tackle everything from real-time voyage optimisation and weather routing to emissions accounting and fuel procurement strategy.

The one major advantage is that these systems don’t just look at route distance, they model total voyage economics, including ETS exposure, port congestion, and fuel pricing across multiple bunkering options. For ships trading into Europe, where even a slight misjudgement in fuel burn or emissions can trigger outsized compliance costs, these tools can be the difference between profit and loss.

AI is also being integrated at the vessel level. Engine management platforms that adjust combustion parameters in real time, based on conditions and fuel quality, are achieving measurable efficiency gains. These aren’t future concepts as they’re working today.

As fuel becomes more than just a cost and as it becomes a regulatory and reputational exposure, these digital tools provide the kind of precision and foresight human planning alone can’t reliably match.

Case in point: adapting in real time

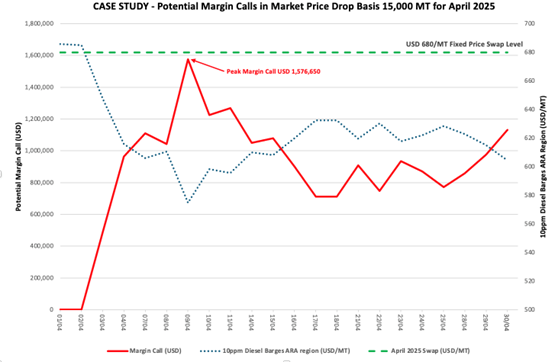

In April 2025, a shipowner entered a traditional fixed-price swap for 10ppm Diesel Barges in the ARA region, locking in USD 680/MT for 15,000 MT. On paper, this looked like a smart hedge—providing cost certainty in a volatile market.

But when the market turned sharply downward, the picture changed.

By 9 April, prices had fallen to USD 574.89/MT – leaving the shipowner facing a mark-to-market loss exceeding USD 1.5 million at the lowest point. This sharp decline triggered a significant margin call, draining liquidity precisely when agility was most critical. By month-end, the index’s average still translated into a realised loss of more than USD 870,000. In contrast, a marine fuel insurance policy on the same index, quantity, and the trigger would have cost a premium of around USD 290,000 – without incurring any further downside for the client during the downturn.

This is the hidden risk of traditional swaps: while they offer price protection, they can demand daily collateral if the market moves against the fixed position—often when cashflow is already under pressure.

The outcome may be positive, but the path can be perilous.

Fuel price protection shouldn’t come with liquidity strain. Marine insurance solutions are built differently and do not have margin calls or collateral requirements. Operators pay a fixed premium upfront, and if fuel prices breach a pre-agreed trigger, claims are paid out automatically protecting earnings without tying up cash along the way.

This turns bunker volatility from a daily operational risk into a clearly defined cost—one that can be budgeted, planned, and strategically managed. Certainty is priceless.

Fuel price protection: from volatility to visibility

For maritime operators navigating today’s unpredictable landscape, fuel price insurance protecting against loss and also provides foresight. This gives decision-makers confidence not only in budgeting, but in bidding and fixture pricing. In a world where margins are tight and regulation is intensifying, insurance isn’t a fallback but a forward-looking strategy.

Conclusion: From cost centre to competitive advantage

In this new era of shipping, it’s not just about weathering volatility but thriving through it.

Treating volatility as a strategic variable which can be analysed, insured, managed, and optimized, is fast becoming the mark of resilient operators. Whether through digital platforms, price protection strategies, or collaborative green transition planning, more tools than ever are now available to adapt effectively and gain a competitive advantage.