Bunkerspot Jan. Feature

Overview

Since January 1, 2010, the European Union’s Sulphur Directive (2005/33/EC) has required ships at berth in EU ports to use fuels with a sulfur content of no more than 0.1% by mass. This mandate has made low-sulfur marine gas oil (MGO) or similar compliant fuels a standard for reducing air pollution during port stays.

As of mid-2024, around 28.3% of the global maritime fleet (by tonnage) is equipped with exhaust gas cleaning systems – commonly known as scrubbers (Clarksons Insights). These systems are crucial for complying with Emission Control Area (ECA) regulations, which aim to cut sulfur oxide emissions.

Scrubber adoption tends to vary across vessel types and sizes, with larger ships leading the way. For instance, 32% of crude oil tankers – representing 38% of the segment’s deadweight capacity – are scrubber-equipped (BIMCO). Similarly, scrubber-equipped container ships now make up a record 36% of the global container fleet.

Mediterranean Sea Emission Control Area (Med ECA) and Market Preparedness

The maritime sector is no stranger to operating in ECAs, and the long-anticipated creation of the Mediterranean ECA (Med ECA) which comes into effect on the 1st May 2025. Many players across the industry have proactively started preparations in order to meet changing thresholds. This readiness has helped ease the transition, reducing the typical disruptions that come with new regulations.

In the tanker market, for example, Worldscale rates already factor in some compliance costs, incorporating them into flat rate calculations. However, specific voyage impacts – such as fuel consumption, route length within ECAs, and price differences between compliant and non-compliant fuels – require additional scrutiny. To address these nuances, shipowners and charterers often renegotiate terms or adjust Worldscale rates.

Challenges with Med ECA Rollout

The initial phase of Med ECA implementation is likely to face supply shortages and logistical challenges as refiners and suppliers adapt their operations. Older ships with inefficient engines that struggle to switch fuel types may find themselves facing higher operational costs or limited trading opportunities.

Vessels operating within Med ECA zones must carefully manage their fuel procurement, ensuring adequate supplies of low-sulfur fuel are onboard. This shift may alter traditional fuel trade patterns, increasing reliance on Med-specific ports for bunkering.

Impact on Operations and Freight Dynamics

The increased requirement of higher-cost low-sulfur fuels is expected to bring about significant shifts in maritime operations and freight dynamics. One likely outcome is the increased adoption of “slow steaming,” particularly for trades that are less time sensitive. This strategy allows vessels to conserve fuel and offset some of the additional expenses incurred by using compliant fuels. However, the practice may also influence broader freight rate trends and impact market behaviour as operators adjust to the new cost environment.

Another consequence of compliance costs, is their inevitable transfer to charterers and cargo owners through increased freight rates. Trades that are highly cost-sensitive, such as coal and grain shipments or short-sea shipping, are likely to bear the brunt of these higher expenses, potentially altering the economic viability of certain routes and cargo types. These adjustments could reshape trade flows and demand patterns within the affected sectors.

Meanwhile, ports located just outside the Emission Control Area (ECA) zones, such as Huelva, might temporarily gain a competitive edge by offering cost-effective bunkering options. These ports could attract vessels seeking to mitigate operating costs, provided they align with planned operational routes. This shift in bunkering preferences may create new patterns in regional port activity, offering cost benefits to operators while influencing the broader landscape of maritime logistics. Together, these factors paint a dynamic picture of how the industry is likely to adapt to the challenges posed by low-sulfur fuel regulations.

Key Considerations for Shipowners and Managers

Understanding key operational aspects is crucial for adapting to the challenges posed by the Med ECA. One important factor to consider is fleet composition. Assessing the percentage of scrubber-equipped vessels in a fleet can help determine the ability to utilise high-sulfur fuel oil (HSFO) while remaining compliant. Additionally, exploring the use of low-carbon fuels like methanol or biofuels could play a significant role in preparing for future regulations. The Med ECA may serve as a catalyst for accelerating the transition to these sustainable fuel options, especially as the industry faces growing pressure to reduce greenhouse gas emissions.

Trading routes are another critical element to evaluate. Are voyages primarily concentrated within the Mediterranean, or do they also extend to non-ECA regions where alternative compliance strategies might be more cost-effective? The nature of trading routes will influence fuel procurement decisions and overall operational planning.

Fuel procurement strategies also require careful attention. Is there a reliance on spot purchases, or are contract terms established with suppliers? Spot purchases may create exposure to greater fuel price volatility, whereas term contracts can provide stability and predictability in operational costs. Evaluating the balance between these approaches is essential for mitigating financial risks and ensuring consistent fuel availability.

Finally, operational priorities must be clearly defined. Is the primary focus on minimizing compliance costs in the short term, or making investments in long-term, low-carbon solutions? Balancing immediate regulatory compliance with strategic initiatives for sustainability will be key to maintaining competitiveness and ensuring long-term viability in an evolving maritime landscape.

Strategic Recommendations

Optimise Vessel Routing

To effectively navigate the challenges posed by the Med ECA, optimizing operational strategies is essential. One key approach is to prioritise vessels on routes within the Med ECA, where these ships can leverage the cost advantages by dynamically monitoring various bunkering whilst maintaining regulatory compliance.

Fuel Procurement Strategies

Fuel procurement strategies also play a critical role in managing the financial impact of stricter fuel regulations. Additionally, exploring medium to long-term fuel hedging strategies which can provide a significant buffer against price volatility. However, many shipowners often have little to no hedging strategies, securing fuel purchases stem to stem, which exposes them to frequent and unpredictable price shocks.

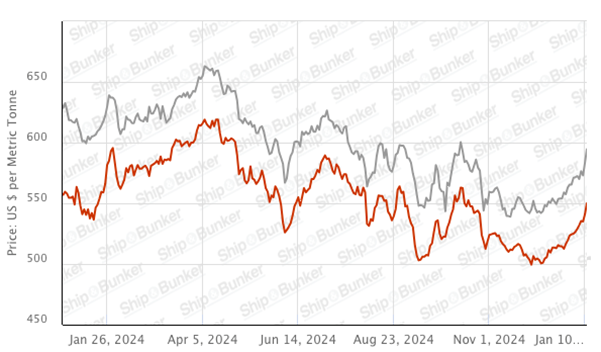

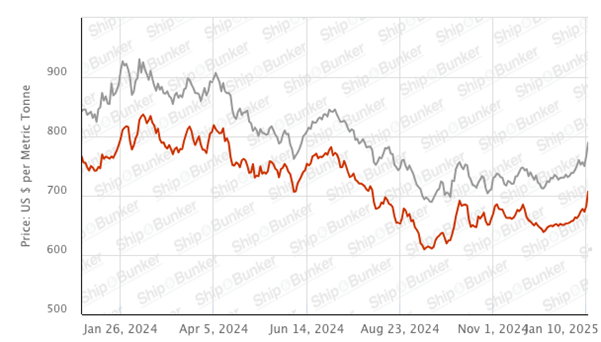

Higher prices in Gibraltar compared to Rotterdam stem from regional demand dynamics and logistics, with volatility moderated by the steady flow of transit shipping. That being said, there have been noticeable volatility between June and August 2024, likely due to external factors such as geopolitical tensions, OPEC decisions, and supply chain fluctuations. Specific demand pressures have led to Gibraltar exhibiting a stronger upward trajectory recently in comparison to Rotterdam – relevant for post MED ECA implementation.

VLSFO:

Red – Rotterdam

Grey – Gibraltar

LSMGO

Red – Rotterdam

Grey – Gibraltar

Source: shipandbunker.com

Note: Please remove ship and bunker watermark on charts

To address this complexity, adopting a long-term perspective and strategy towards marine fuel price risk is essential for effective business management, supported by sustained risk coverage. While traditional derivative structures, such as fixed-priced swaps and options structures, can reduce certain risks, they still carry significant market risk which could result in sizeable margin calls and realised losses, leaving shipowners vulnerable to abrupt market changes. Considering the value and lifespan of a fleet, optimising revenue potential requires a more comprehensive and forward-looking approach, such as fuel price insurance, which is more aligned to shipowner/charterers needs.

Explore Alternative Bunkering Ports

In addition, alternative bunkering locations outside ECA zones, present valuable opportunities for cost savings. These ports can serve as strategic hubs, allowing operators to benefit from lower fuel costs when such routes align with operational plans. Evaluating these options carefully can optimize logistical efficiency while keeping compliance costs manageable.

Future-Proof Your Fleet

Looking ahead, future-proofing a fleet is crucial to staying competitive in an evolving regulatory environment. Keeping abreast of developments like FuelEU Maritime is vital to ensure that fleet retrofits and upgrades address not only sulfur reduction requirements but also emerging greenhouse gas (GHG) targets. By aligning current investments with long-term sustainability goals, operators can secure both compliance and a strategic advantage in the transition toward greener shipping practices.